Page 29 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 29

Session Unit 16:

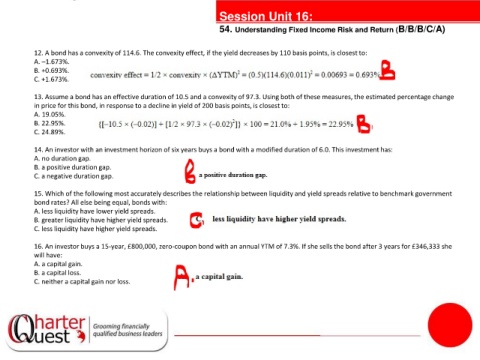

54. Understanding Fixed Income Risk and Return (B/B/B/C/A)

12. A bond has a convexity of 114.6. The convexity effect, if the yield decreases by 110 basis points, is closest to:

A. –1.673%.

B. +0.693%.

C. +1.673%.

13. Assume a bond has an effective duration of 10.5 and a convexity of 97.3. Using both of these measures, the estimated percentage change

in price for this bond, in response to a decline in yield of 200 basis points, is closest to:

A. 19.05%.

B. 22.95%.

C. 24.89%.

14. An investor with an investment horizon of six years buys a bond with a modified duration of 6.0. This investment has:

A. no duration gap. tanties

B. a positive duration gap.

C. a negative duration gap.

15. Which of the following most accurately describes the relationship between liquidity and yield spreads relative to benchmark government

bond rates? All else being equal, bonds with:

A. less liquidity have lower yield spreads.

B. greater liquidity have higher yield spreads.

C. less liquidity have higher yield spreads.

16. An investor buys a 15-year, £800,000, zero-coupon bond with an annual YTM of 7.3%. If she sells the bond after 3 years for £346,333 she

will have:

A. a capital gain.

B. a capital loss.

C. neither a capital gain nor loss.