Page 34 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 34

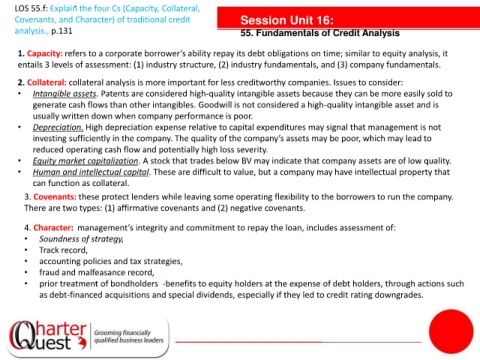

LOS 55.f: Explain the four Cs (Capacity, Collateral,

Covenants, and Character) of traditional credit Session Unit 16:

analysis., p.131 55. Fundamentals of Credit Analysis

1. Capacity: refers to a corporate borrower’s ability repay its debt obligations on time; similar to equity analysis, it

entails 3 levels of assessment: (1) industry structure, (2) industry fundamentals, and (3) company fundamentals.

2. Collateral: collateral analysis is more important for less creditworthy companies. Issues to consider:

• Intangible assets. Patents are considered high-quality intangible assets because they can be more easily sold to

generate cash flows than other intangibles. Goodwill is not considered a high-quality intangible asset and is

usually written down when company performance is poor.

• Depreciation. High depreciation expense relative to capital expenditures may signal that management is not

investing sufficiently in the company. The quality of the company’s assets may be poor, which may lead to

tanties

reduced operating cash flow and potentially high loss severity.

• Equity market capitalization. A stock that trades below BV may indicate that company assets are of low quality.

• Human and intellectual capital. These are difficult to value, but a company may have intellectual property that

can function as collateral.

3. Covenants: these protect lenders while leaving some operating flexibility to the borrowers to run the company.

There are two types: (1) affirmative covenants and (2) negative covenants.

4. Character: management’s integrity and commitment to repay the loan, includes assessment of:

• Soundness of strategy,

• Track record,

• accounting policies and tax strategies,

• fraud and malfeasance record,

• prior treatment of bondholders -benefits to equity holders at the expense of debt holders, through actions such

as debt-financed acquisitions and special dividends, especially if they led to credit rating downgrades.