Page 12 - Gross Income class slides

P. 12

GROSS INCOMEOSS INCOME

GR

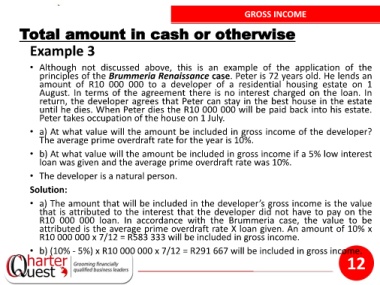

Total amount in cash or otherwise

Example 3

• Although not discussed above, this is an example of the application of the

principles of the Brummeria Renaissance case. Peter is 72 years old. He lends an

amount of R10 000 000 to a developer of a residential housing estate on 1

August. In terms of the agreement there is no interest charged on the loan. In

return, the developer agrees that Peter can stay in the best house in the estate

until he dies. When Peter dies the R10 000 000 will be paid back into his estate.

Peter takes occupation of the house on 1 July.

• a) At what value will the amount be included in gross income of the developer?

The average prime overdraft rate for the year is 10%.

• b) At what value will the amount be included in gross income if a 5% low interest

loan was given and the average prime overdraft rate was 10%.

• The developer is a natural person.

Solution:

• a) The amount that will be included in the developer’s gross income is the value

that is attributed to the interest that the developer did not have to pay on the

R10 000 000 loan. In accordance with the Brummeria case, the value to be

attributed is the average prime overdraft rate X loan given. An amount of 10% x

R10 000 000 x 7/12 = R583 333 will be included in gross income.

• b) (10% - 5%) x R10 000 000 x 7/12 = R291 667 will be included in gross income.

12