Page 13 - Gross Income class slides

P. 13

GROSS INCOMEOSS INCOME

GR

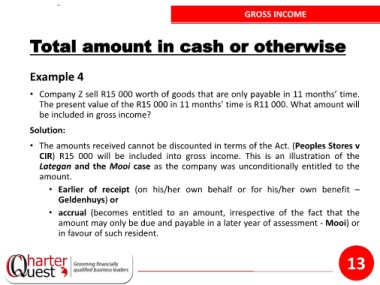

Total amount in cash or otherwise

Example 4

• Company Z sell R15 000 worth of goods that are only payable in 11 months’ time.

The present value of the R15 000 in 11 months’ time is R11 000. What amount will

be included in gross income?

Solution:

• The amounts received cannot be discounted in terms of the Act. (Peoples Stores v

CIR) R15 000 will be included into gross income. This is an illustration of the

Lategan and the Mooi case as the company was unconditionally entitled to the

amount.

• Earlier of receipt (on his/her own behalf or for his/her own benefit –

Geldenhuys) or

• accrual (becomes entitled to an amount, irrespective of the fact that the

amount may only be due and payable in a later year of assessment - Mooi) or

in favour of such resident.

13