Page 18 - Gross Income class slides

P. 18

GROSS INCOMEOSS INCOME

GR

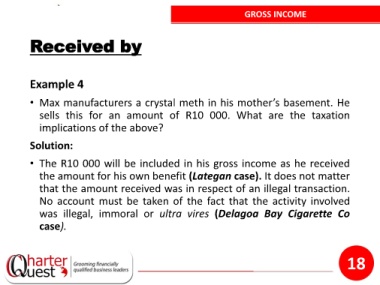

Received by

Example 4

• Max manufacturers a crystal meth in his mother’s basement. He

sells this for an amount of R10 000. What are the taxation

implications of the above?

Solution:

• The R10 000 will be included in his gross income as he received

the amount for his own benefit (Lategan case). It does not matter

that the amount received was in respect of an illegal transaction.

No account must be taken of the fact that the activity involved

was illegal, immoral or ultra vires (Delagoa Bay Cigarette Co

case).

18