Page 17 - Gross Income class slides

P. 17

GROSS INCOMEOSS INCOME

GR

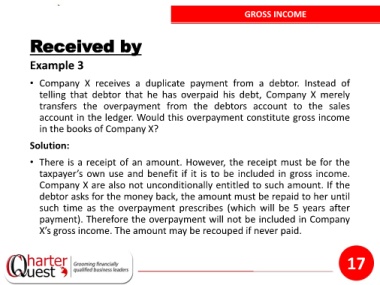

Received by

Example 3

• Company X receives a duplicate payment from a debtor. Instead of

telling that debtor that he has overpaid his debt, Company X merely

transfers the overpayment from the debtors account to the sales

account in the ledger. Would this overpayment constitute gross income

in the books of Company X?

Solution:

• There is a receipt of an amount. However, the receipt must be for the

taxpayer’s own use and benefit if it is to be included in gross income.

Company X are also not unconditionally entitled to such amount. If the

debtor asks for the money back, the amount must be repaid to her until

such time as the overpayment prescribes (which will be 5 years after

payment). Therefore the overpayment will not be included in Company

X’s gross income. The amount may be recouped if never paid.

17