Page 35 - Gross Income class slides

P. 35

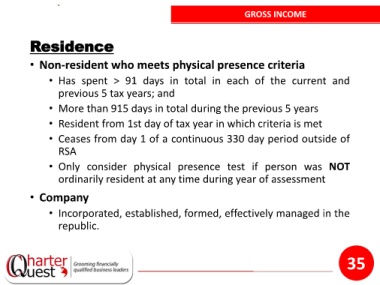

GROSS INCOME

Residence

• Non-resident who meets physical presence criteria

• Has spent > 91 days in total in each of the current and

previous 5 tax years; and

• More than 915 days in total during the previous 5 years

• Resident from 1st day of tax year in which criteria is met

• Ceases from day 1 of a continuous 330 day period outside of

RSA

• Only consider physical presence test if person was NOT

ordinarily resident at any time during year of assessment

• Company

• Incorporated, established, formed, effectively managed in the

republic.

35