Page 39 - Gross Income class slides

P. 39

GROSS INCOME

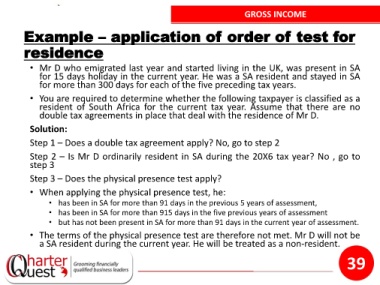

Example – application of order of test for

residence

• Mr D who emigrated last year and started living in the UK, was present in SA

for 15 days holiday in the current year. He was a SA resident and stayed in SA

for more than 300 days for each of the five preceding tax years.

• You are required to determine whether the following taxpayer is classified as a

resident of South Africa for the current tax year. Assume that there are no

double tax agreements in place that deal with the residence of Mr D.

Solution:

Step 1 – Does a double tax agreement apply? No, go to step 2

Step 2 – Is Mr D ordinarily resident in SA during the 20X6 tax year? No , go to

step 3

Step 3 – Does the physical presence test apply?

• When applying the physical presence test, he:

• has been in SA for more than 91 days in the previous 5 years of assessment,

• has been in SA for more than 915 days in the five previous years of assessment

• but has not been present in SA for more than 91 days in the current year of assessment.

• The terms of the physical presence test are therefore not met. Mr D will not be

a SA resident during the current year. He will be treated as a non-resident.

39