Page 42 - Gross Income class slides

P. 42

GROSS INCOME

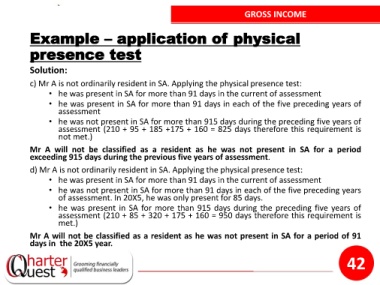

Example – application of physical

presence test

Solution:

c) Mr A is not ordinarily resident in SA. Applying the physical presence test:

• he was present in SA for more than 91 days in the current of assessment

• he was present in SA for more than 91 days in each of the five preceding years of

assessment

• he was not present in SA for more than 915 days during the preceding five years of

assessment (210 + 95 + 185 +175 + 160 = 825 days therefore this requirement is

not met.)

Mr A will not be classified as a resident as he was not present in SA for a period

exceeding 915 days during the previous five years of assessment.

d) Mr A is not ordinarily resident in SA. Applying the physical presence test:

• he was present in SA for more than 91 days in the current of assessment

• he was not present in SA for more than 91 days in each of the five preceding years

of assessment. In 20X5, he was only present for 85 days.

• he was present in SA for more than 915 days during the preceding five years of

assessment (210 + 85 + 320 + 175 + 160 = 950 days therefore this requirement is

met.)

Mr A will not be classified as a resident as he was not present in SA for a period of 91

days in the 20X5 year.

42