Page 41 - Gross Income class slides

P. 41

GROSS INCOME

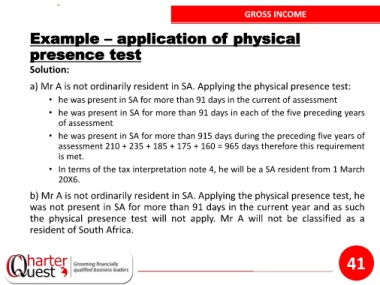

Example – application of physical

presence test

Solution:

a) Mr A is not ordinarily resident in SA. Applying the physical presence test:

• he was present in SA for more than 91 days in the current of assessment

• he was present in SA for more than 91 days in each of the five preceding years

of assessment

• he was present in SA for more than 915 days during the preceding five years of

assessment 210 + 235 + 185 + 175 + 160 = 965 days therefore this requirement

is met.

• In terms of the tax interpretation note 4, he will be a SA resident from 1 March

20X6.

b) Mr A is not ordinarily resident in SA. Applying the physical presence test, he

was not present in SA for more than 91 days in the current year and as such

the physical presence test will not apply. Mr A will not be classified as a

resident of South Africa.

41