Page 46 - Gross Income class slides

P. 46

GROSS INCOME

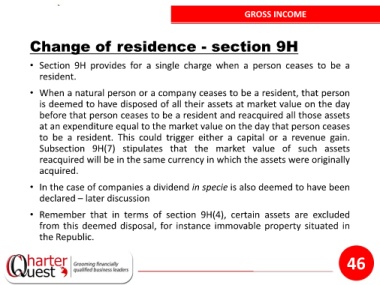

Change of residence - section 9H

• Section 9H provides for a single charge when a person ceases to be a

resident.

• When a natural person or a company ceases to be a resident, that person

is deemed to have disposed of all their assets at market value on the day

before that person ceases to be a resident and reacquired all those assets

at an expenditure equal to the market value on the day that person ceases

to be a resident. This could trigger either a capital or a revenue gain.

Subsection 9H(7) stipulates that the market value of such assets

reacquired will be in the same currency in which the assets were originally

acquired.

• In the case of companies a dividend in specie is also deemed to have been

declared – later discussion

• Remember that in terms of section 9H(4), certain assets are excluded

from this deemed disposal, for instance immovable property situated in

the Republic.

46