Page 40 - Gross Income class slides

P. 40

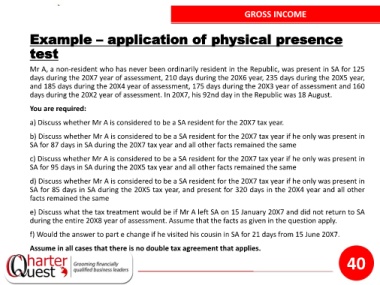

GROSS INCOME

Example – application of physical presence

test

Mr A, a non-resident who has never been ordinarily resident in the Republic, was present in SA for 125

days during the 20X7 year of assessment, 210 days during the 20X6 year, 235 days during the 20X5 year,

and 185 days during the 20X4 year of assessment, 175 days during the 20X3 year of assessment and 160

days during the 20X2 year of assessment. In 20X7, his 92nd day in the Republic was 18 August.

You are required:

a) Discuss whether Mr A is considered to be a SA resident for the 20X7 tax year.

b) Discuss whether Mr A is considered to be a SA resident for the 20X7 tax year if he only was present in

SA for 87 days in SA during the 20X7 tax year and all other facts remained the same

c) Discuss whether Mr A is considered to be a SA resident for the 20X7 tax year if he only was present in

SA for 95 days in SA during the 20X5 tax year and all other facts remained the same

d) Discuss whether Mr A is considered to be a SA resident for the 20X7 tax year if he only was present in

SA for 85 days in SA during the 20X5 tax year, and present for 320 days in the 20X4 year and all other

facts remained the same

e) Discuss what the tax treatment would be if Mr A left SA on 15 January 20X7 and did not return to SA

during the entire 20X8 year of assessment. Assume that the facts as given in the question apply.

f) Would the answer to part e change if he visited his cousin in SA for 21 days from 15 June 20X7.

Assume in all cases that there is no double tax agreement that applies.

40