Page 260 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 260

Chapter 10

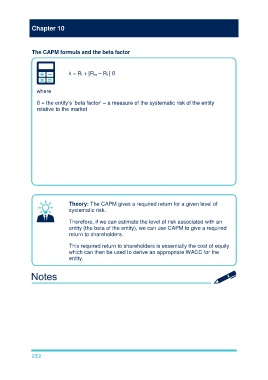

The CAPM formula and the beta factor

k = R f + [R m – R f ] ß

where

ß = the entity’s ‘beta factor’ – a measure of the systematic risk of the entity

relative to the market

N.B. It is assumed that investors are well diversified

k = required rate of return of the investor

R f = risk-free rate of interest

R m = return on market portfolio

R m – R f = market premium

ß = 1 is the average for the market

Theory: The CAPM gives a required return for a given level of

systematic risk.

Therefore, if we can estimate the level of risk associated with an

entity (the beta of the entity), we can use CAPM to give a required

return to shareholders.

This required return to shareholders is essentially the cost of equity

which can then be used to derive an appropriate WACC for the

entity.

252