Page 29 - CIMA May 18 - MCS Day 1 Suggested Solution

P. 29

SUGGESTED SOLUTIONS

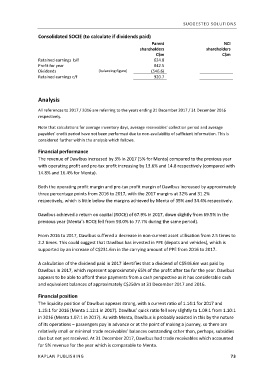

Consolidated SOCIE (to calculate if dividends paid)

Parent NCI

shareholders shareholders

C$m C$m

Retained earnings b/f 624.8

Profit for year 842.5

Dividends (balancing figure) (546.6)

Retained earnings c/f 920.7

Analysis

All references to 2017 / 2016 are referring to the years ending 31 December 2017 / 31 December 2016

respectively.

Note that calculations for average inventory days, average receivables’ collection period and average

payables’ credit period have not been performed due to non‐availability of sufficient information. This is

considered further within the analysis which follows.

Financial performance

The revenue of Dawlbus increased by 3% in 2017 (5% for Menta) compared to the previous year

with operating profit and pre‐tax profit increasing by 13.6% and 14.8 respectively (compared with

14.8% and 16.4% for Menta).

Both the operating profit margin and pre‐tax profit margin of Dawlbus increased by approximately

three percentage points from 2016 to 2017, with the 2017 margins at 32% and 31.2%

respectively, which is little below the margins achieved by Menta of 35% and 34.4% respectively.

Dawlbus achieved a return on capital (ROCE) of 67.9% in 2017, down slightly from 69.5% in the

previous year (Menta’s ROCE fell from 93.0% to 77.7% during the same period).

From 2016 to 2017, Dawlbus suffered a decrease in non‐current asset utilisation from 2.5 times to

2.2 times. This could suggest that Dawlbus has invested in PPE (depots and vehicles), which is

supported by an increase of C$231.6m in the carrying amount of PPE from 2016 to 2017.

A calculation of the dividend paid in 2017 identifies that a dividend of C$546.6m was paid by

Dawlbus in 2017, which represent approximately 65% of the profit after tax for the year. Dawlbus

appears to be able to afford these payments from a cash perspective as it has considerable cash

and equivalent balances of approximately C$250m at 31 December 2017 and 2016.

Financial position

The liquidity position of Dawlbus appears strong, with a current ratio of 1.14:1 for 2017 and

1.15:1 for 2016 (Menta 1.12:1 in 2017). Dawlbus’ quick ratio fell very slightly to 1.09:1 from 1.10:1

in 2016 (Menta 1.07:1 in 2017). As with Menta, Dawlbus is probably assisted in this by the nature

of its operations – passengers pay in advance or at the point of making a journey, so there are

relatively small or minimal trade receivables’ balances outstanding other than, perhaps, subsidies

due but not yet received. At 31 December 2017, Dawlbus had trade receivables which accounted

for 5% revenue for the year which is comparable to Menta.

KAPLAN PUBLISHING 73