Page 269 - Microsoft Word - 00 IWB ACCA F7.docx

P. 269

Interpretation of financial statements

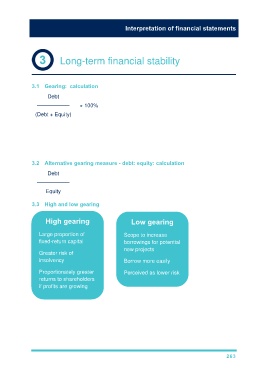

Long-term financial stability

3.1 Gearing: calculation

Debt

—————— × 100%

(Debt + Equity)

Debt includes all long-term borrowings, e.g. loan notes, redeemable preference

shares.

Equity includes all elements of equity, e.g. share capital, reserves, non-controlling

interest.

3.2 Alternative gearing measure - debt: equity: calculation

Debt

——————

Equity

3.3 High and low gearing

High gearing Low gearing

Large proportion of Scope to increase

fixed-return capital borrowings for potential

Greater risk of new projects

insolvency Borrow more easily

Proportionately greater Perceived as lower risk

returns to shareholders

if profits are growing

263