Page 265 - Microsoft Word - 00 IWB ACCA F7.docx

P. 265

Interpretation of financial statements

2.6 Inventory ratios: reasons for movement

improved/worse inventory control

obsolete inventory

increased level of inventory to stimulate sales

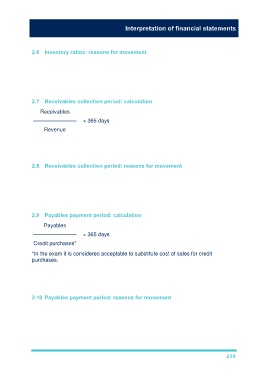

2.7 Receivables collection period: calculation

Receivables

———————— × 365 days

Revenue

average number of days to collect receivables balances

lower days = higher efficiency

2.8 Receivables collection period: reasons for movement

improved/worse credit control

irrecoverable debts

increased credit terms to stimulate sales

2.9 Payables payment period: calculation

Payables

———————— × 365 days

Credit purchases*

*In the exam it is considered acceptable to substitute cost of sales for credit

purchases.

average number of days taken to pay suppliers

higher days = greater benefit

2.10 Payables payment period: reasons for movement

new credit arrangement

new supplier

higher days may indicate inability to pay

Increasing payment period may give company reputation as poor payer.

259