Page 3 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 3

LOS 11.a: Calculate and interpret the bid–offer spread on a

spot or forward currency quotation and describe the READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

factors that affect the bid–offer spread.

MODULE 11.1: FOREX QUOTES, SPREADS, AND TRIANGULAR

ARBITRAGE

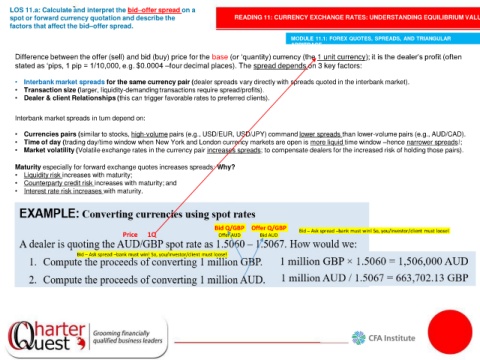

Difference between the offer (sell) and bid (buy) price for the base (or ‘quantity) currency (the 1 unit currency); it is the dealer’s profit (often

stated as ‘pips, 1 pip = 1/10,000, e.g. $0.0004 –four decimal places). The spread depends on 3 key factors:

• Interbank market spreads for the same currency pair (dealer spreads vary directly with spreads quoted in the interbank market).

• Transaction size (larger, liquidity-demanding transactions require spread/profits).

• Dealer & client Relationships (this can trigger favorable rates to preferred clients).

Interbank market spreads in turn depend on:

• Currencies pairs (similar to stocks, high-volume pairs (e.g., USD/EUR, USD/JPY) command lower spreads than lower-volume pairs (e.g., AUD/CAD).

• Time of day (trading day/time window when New York and London currency markets are open is more liquid time window –hence narrower spreads!;

• Market volatility (Volatile exchange rates in the currency pair increases spreads; to compensate dealers for the increased risk of holding those pairs).

Maturity especially for forward exchange quotes increases spreads: Why?

• Liquidity risk increases with maturity;

• Counterparty credit risk increases with maturity; and

• Interest rate risk increases with maturity.

Bid Q/GBP Offer Q/GBP Bid – Ask spread –bank must win! So, you/investor/client must loose!

Price 1Q Offer AUD Bid AUD

Bid – Ask spread –bank must win! So, you/investor/client must loose!