Page 7 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 7

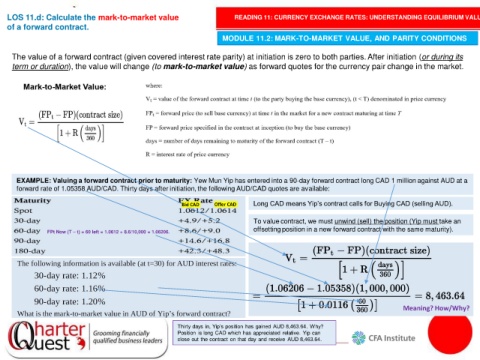

LOS 11.d: Calculate the mark-to-market value READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

of a forward contract.

MODULE 11.2: MARK-TO-MARKET VALUE, AND PARITY CONDITIONS

The value of a forward contract (given covered interest rate parity) at initiation is zero to both parties. After initiation (or during its

term or duration), the value will change (to mark-to-market value) as forward quotes for the currency pair change in the market.

EXAMPLE: Valuing a forward contract prior to maturity: Yew Mun Yip has entered into a 90-day forward contract long CAD 1 million against AUD at a

forward rate of 1.05358 AUD/CAD. Thirty days after initiation, the following AUD/CAD quotes are available:

Bid CAD Offer CAD Long CAD means Yip’s contract calls for Buying CAD (selling AUD).

To value contract, we must unwind (sell) the position (Yip must take an

offsetting position in a new forward contract with the same maturity).

FPt Now (T – t) = 60 left = 1.0612 + 8.6/10,000 = 1.06206.

Meaning? How/Why?

Thirty days in, Yip’s position has gained AUD 8,463.64. Why?

Position is long CAD which has appreciated relative. Yip can

close out the contract on that day and receive AUD 8,463.64.