Page 8 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 8

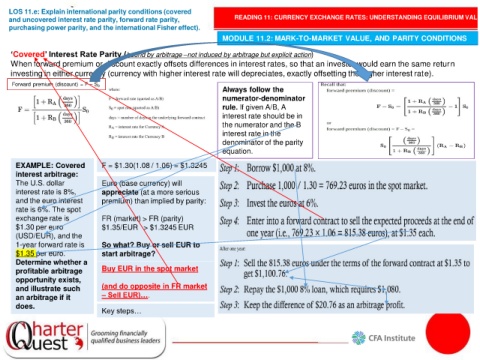

LOS 11.e: Explain international parity conditions (covered

and uncovered interest rate parity, forward rate parity, READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

purchasing power parity, and the international Fisher effect).

MODULE 11.2: MARK-TO-MARKET VALUE, AND PARITY CONDITIONS

‘Covered’ Interest Rate Parity (bound by arbitrage –not induced by arbitrage but explicit action)

When forward premium or discount exactly offsets differences in interest rates, so that an investor would earn the same return

investing in either currency (currency with higher interest rate will depreciates, exactly offsetting the higher interest rate).

Forward premium (discount) = F – S 0

Always follow the

numerator-denominator

rule. If given A/B, A

interest rate should be in

the numerator and the B

interest rate in the

denominator of the parity

equation.

EXAMPLE: Covered F = $1.30(1.08 / 1.06) = $1.3245

interest arbitrage:

The U.S. dollar Euro (base currency) will

interest rate is 8%, appreciate (at a more serious

and the euro interest premium) than implied by parity:

rate is 6%. The spot

exchange rate is FR (market) > FR (parity)

$1.30 per euro $1.35/EUR > $1.3245 EUR

(USD/EUR), and the

1-year forward rate is So what? Buy or sell EUR to

$1.35 per euro. start arbitrage?

Determine whether a

profitable arbitrage Buy EUR in the spot market

opportunity exists,

and illustrate such (and do opposite in FR market

an arbitrage if it – Sell EUR)….

does.

Key steps…