Page 13 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 13

LOS 11.g: Evaluate the use of the current spot rate, the forward

rate, purchasing power parity, and uncovered interest parity to READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

forecast future spot exchange rates.

MODULE 11.2: MARK-TO-MARKET VALUE, AND PARITY CONDITIONS

LOS 11.h: Explain approaches to assessing the long-run fair

value of an exchange rate.

Use ex-ante PPP, UCIRP, or forward rates to forecast future spot rates.

UCIRP & PPP are not bound by arbitrage and seldom work over the short and medium terms.

If relative PPP holds at any point in time, the real exchange rate would be constant.

However, since relative PPP seldom holds over the short term, the real exchange rate fluctuates around its mean-reverting equilibrium value.

The IFR (and real rate parity) assumes no differences between sovereign risk premia, but we know investors do demand a risk premium)

for investing in emerging market!

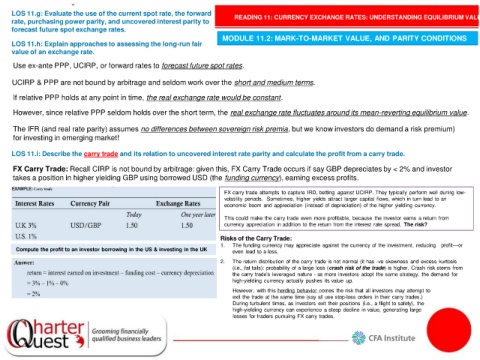

LOS 11.i: Describe the carry trade and its relation to uncovered interest rate parity and calculate the profit from a carry trade.

FX Carry Trade: Recall CIRP is not bound by arbitrage: given this, FX Carry Trade occurs if say GBP depreciates by < 2% and investor

takes a position in higher yielding GBP using borrowed USD (the funding currency), earning excess profits.

FX carry trade attempts to capture IRD, betting against UCIRP. They typically perform well during low-

volatility periods. Sometimes, higher yields attract larger capital flows, which in turn lead to an

economic boom and appreciation (instead of depreciation) of the higher yielding currency.

This could make the carry trade even more profitable, because the investor earns a return from

currency appreciation in addition to the return from the interest rate spread. The risk?

Risks of the Carry Trade:

1. The funding currency may appreciate against the currency of the investment, reducing profit—or

Compute the profit to an investor borrowing in the US & investing in the UK even lead to a loss.

2. The return distribution of the carry trade is not normal (it has -ve skewness and excess kurtosis

(i.e., fat tails): probability of a large loss (crash risk of the trade) is higher. Crash risk stems from

the carry trade’s leveraged nature - as more investors adopt the same strategy, the demand for

high-yielding currency actually pushes its value up.

However, with this herding behavior comes the risk that all investors may attempt to

exit the trade at the same time (say all use stop-loss orders in their carry trades.)

During turbulent times, as investors exit their positions (i.e., a flight to safety), the

high-yielding currency can experience a steep decline in value, generating large

losses for traders pursuing FX carry trades.