Page 15 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 15

LOS 11.k: Explain the potential effects of READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

monetary and fiscal policy on exchange rates.

MODULE 11.3: EXCHANGE RATE DETERMINANTS, CARRY TRADE, AND

MUNDELL-FLEMING MODEL CENTRAL BANK INFLUENCE

Assumes there is sufficient slack in the economy to handle changes in aggregate demand, and that inflation is not a concern: 2 Implications:

Flexible Exchange Rate Regimes – 2 scenarios – International capital flows are relatively:

1. Unrestricted (high mobility of capital); versus

2. Restricted (low mobility of capital).

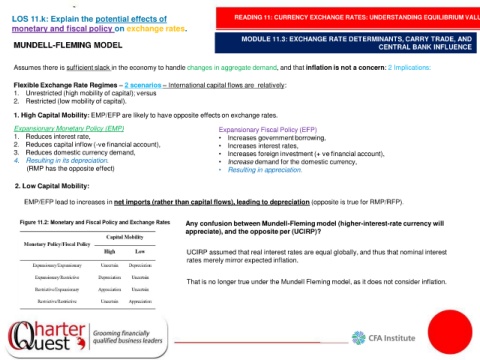

1. High Capital Mobility: EMP/EFP are likely to have opposite effects on exchange rates.

Expansionary Monetary Policy (EMP) Expansionary Fiscal Policy (EFP)

1. Reduces interest rate, • Increases government borrowing,

2. Reduces capital inflow (-ve financial account), • Increases interest rates,

3. Reduces domestic currency demand, • Increases foreign investment (+ ve financial account),

4. Resulting in its depreciation. • Increase demand for the domestic currency,

(RMP has the opposite effect) • Resulting in appreciation.

2. Low Capital Mobility:

EMP/EFP lead to increases in net imports (rather than capital flows), leading to depreciation (opposite is true for RMP/RFP).

Any confusion between Mundell-Fleming model (higher-interest-rate currency will

appreciate), and the opposite per (UCIRP)?

UCIRP assumed that real interest rates are equal globally, and thus that nominal interest

rates merely mirror expected inflation.

That is no longer true under the Mundell Fleming model, as it does not consider inflation.