Page 14 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 14

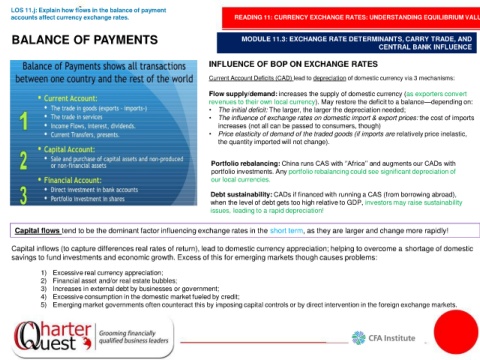

LOS 11.j: Explain how flows in the balance of payment

accounts affect currency exchange rates. READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

BALANCE OF PAYMENTS MODULE 11.3: EXCHANGE RATE DETERMINANTS, CARRY TRADE, AND

CENTRAL BANK INFLUENCE

INFLUENCE OF BOP ON EXCHANGE RATES

Current Account Deficits (CAD) lead to depreciation of domestic currency via 3 mechanisms:

Flow supply/demand: increases the supply of domestic currency (as exporters convert

revenues to their own local currency). May restore the deficit to a balance—depending on:

• The initial deficit: The larger, the larger the depreciation needed;

• The influence of exchange rates on domestic import & export prices: the cost of imports

increases (not all can be passed to consumers, though)

• Price elasticity of demand of the traded goods (if imports are relatively price inelastic,

the quantity imported will not change).

Portfolio rebalancing: China runs CAS with ‘’Africa’’ and augments our CADs with

portfolio investments. Any portfolio rebalancing could see significant depreciation of

our local currencies.

Debt sustainability: CADs if financed with running a CAS (from borrowing abroad),

when the level of debt gets too high relative to GDP, investors may raise sustainability

issues, leading to a rapid depreciation!

Capital flows tend to be the dominant factor influencing exchange rates in the short term, as they are larger and change more rapidly!

Capital inflows (to capture differences real rates of return), lead to domestic currency appreciation; helping to overcome a shortage of domestic

savings to fund investments and economic growth. Excess of this for emerging markets though causes problems:

1) Excessive real currency appreciation;

2) Financial asset and/or real estate bubbles;

3) Increases in external debt by businesses or government;

4) Excessive consumption in the domestic market fueled by credit;

5) Emerging market governments often counteract this by imposing capital controls or by direct intervention in the foreign exchange markets.