Page 18 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 18

READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

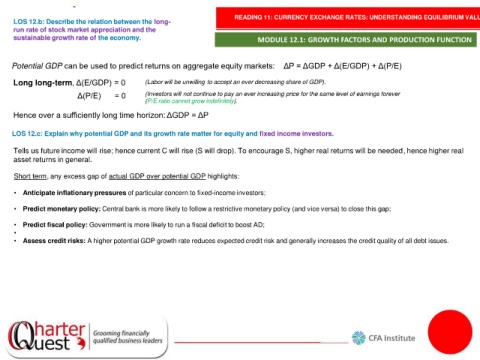

LOS 12.b: Describe the relation between the long-

run rate of stock market appreciation and the

sustainable growth rate of the economy. MODULE 12.1: GROWTH FACTORS AND PRODUCTION FUNCTION

Potential GDP can be used to predict returns on aggregate equity markets: ΔP = ΔGDP + Δ(E/GDP) + Δ(P/E)

Long long-term, Δ(E/GDP) = 0 (Labor will be unwilling to accept an ever decreasing share of GDP).

Δ(P/E) = 0 (Investors will not continue to pay an ever increasing price for the same level of earnings forever

(P/E ratio cannot grow indefinitely).

Hence over a sufficiently long time horizon: ΔGDP = ΔP

LOS 12.c: Explain why potential GDP and its growth rate matter for equity and fixed income investors.

Tells us future income will rise; hence current C will rise (S will drop). To encourage S, higher real returns will be needed, hence higher real

asset returns in general.

Short term, any excess gap of actual GDP over potential GDP highlights:

• Anticipate inflationary pressures of particular concern to fixed-income investors;

• Predict monetary policy: Central bank is more likely to follow a restrictive monetary policy (and vice versa) to close this gap;

• Predict fiscal policy: Government is more likely to run a fiscal deficit to boost AD;

•

• Assess credit risks: A higher potential GDP growth rate reduces expected credit risk and generally increases the credit quality of all debt issues.