Page 23 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 23

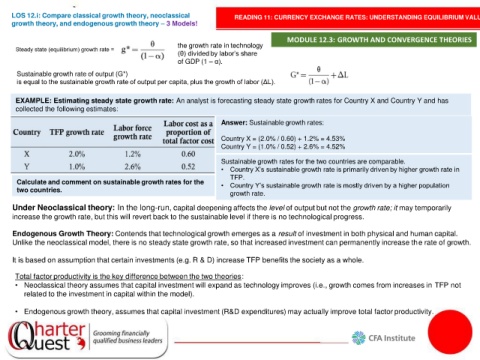

LOS 12.i: Compare classical growth theory, neoclassical READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

growth theory, and endogenous growth theory – 3 Models!

MODULE 12.3: GROWTH AND CONVERGENCE THEORIES

the growth rate in technology

(θ) divided by labor’s share

of GDP (1 – α).

Sustainable growth rate of output (G*)

is equal to the sustainable growth rate of output per capita, plus the growth of labor (ΔL).

EXAMPLE: Estimating steady state growth rate: An analyst is forecasting steady state growth rates for Country X and Country Y and has

collected the following estimates:

Answer: Sustainable growth rates:

Country X = (2.0% / 0.60) + 1.2% = 4.53%

Country Y = (1.0% / 0.52) + 2.6% = 4.52%

Sustainable growth rates for the two countries are comparable.

• Country X’s sustainable growth rate is primarily driven by higher growth rate in

TFP.

Calculate and comment on sustainable growth rates for the • Country Y’s sustainable growth rate is mostly driven by a higher population

two countries.

growth rate.

Under Neoclassical theory: In the long-run, capital deepening affects the level of output but not the growth rate; it may temporarily

increase the growth rate, but this will revert back to the sustainable level if there is no technological progress.

Endogenous Growth Theory: Contends that technological growth emerges as a result of investment in both physical and human capital.

Unlike the neoclassical model, there is no steady state growth rate, so that increased investment can permanently increase the rate of growth.

It is based on assumption that certain investments (e.g. R & D) increase TFP benefits the society as a whole.

Total factor productivity is the key difference between the two theories:

• Neoclassical theory assumes that capital investment will expand as technology improves (i.e., growth comes from increases in TFP not

related to the investment in capital within the model).

• Endogenous growth theory, assumes that capital investment (R&D expenditures) may actually improve total factor productivity.