Page 24 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 24

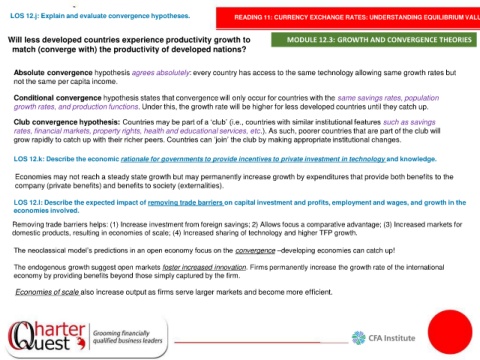

LOS 12.j: Explain and evaluate convergence hypotheses. READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

Will less developed countries experience productivity growth to MODULE 12.3: GROWTH AND CONVERGENCE THEORIES

match (converge with) the productivity of developed nations?

Absolute convergence hypothesis agrees absolutely: every country has access to the same technology allowing same growth rates but

not the same per capita income.

Conditional convergence hypothesis states that convergence will only occur for countries with the same savings rates, population

growth rates, and production functions. Under this, the growth rate will be higher for less developed countries until they catch up.

Club convergence hypothesis: Countries may be part of a ‘club’ (i.e., countries with similar institutional features such as savings

rates, financial markets, property rights, health and educational services, etc.). As such, poorer countries that are part of the club will

grow rapidly to catch up with their richer peers. Countries can ‘join’ the club by making appropriate institutional changes.

LOS 12.k: Describe the economic rationale for governments to provide incentives to private investment in technology and knowledge.

Economies may not reach a steady state growth but may permanently increase growth by expenditures that provide both benefits to the

company (private benefits) and benefits to society (externalities).

LOS 12.l: Describe the expected impact of removing trade barriers on capital investment and profits, employment and wages, and growth in the

economies involved.

Removing trade barriers helps: (1) Increase investment from foreign savings; 2) Allows focus a comparative advantage; (3) Increased markets for

domestic products, resulting in economies of scale; (4) Increased sharing of technology and higher TFP growth.

The neoclassical model’s predictions in an open economy focus on the convergence –developing economies can catch up!

The endogenous growth suggest open markets foster increased innovation. Firms permanently increase the growth rate of the international

economy by providing benefits beyond those simply captured by the firm.

Economies of scale also increase output as firms serve larger markets and become more efficient.