Page 22 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 22

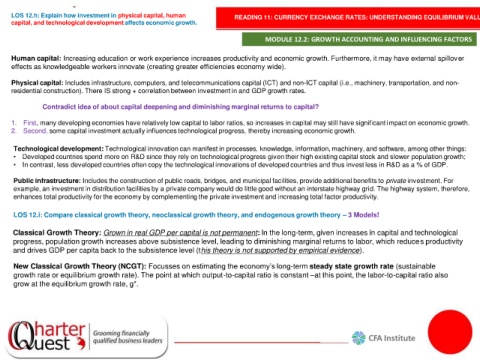

LOS 12.h: Explain how investment in physical capital, human READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

capital, and technological development affects economic growth.

MODULE 12.2: GROWTH ACCOUNTING AND INFLUENCING FACTORS

Human capital: Increasing education or work experience increases productivity and economic growth. Furthermore, it may have external spillover

effects as knowledgeable workers innovate (creating greater efficiencies economy wide).

Physical capital: Includes infrastructure, computers, and telecommunications capital (ICT) and non-ICT capital (i.e., machinery, transportation, and non-

residential construction). There IS strong + correlation between investment in and GDP growth rates.

Contradict idea of about capital deepening and diminishing marginal returns to capital?

1. First, many developing economies have relatively low capital to labor ratios, so increases in capital may still have significant impact on economic growth.

2. Second, some capital investment actually influences technological progress, thereby increasing economic growth.

Technological development: Technological innovation can manifest in processes, knowledge, information, machinery, and software, among other things:

• Developed countries spend more on R&D since they rely on technological progress given their high existing capital stock and slower population growth;

• In contrast, less developed countries often copy the technological innovations of developed countries and thus invest less in R&D as a % of GDP.

Public infrastructure: Includes the construction of public roads, bridges, and municipal facilities, provide additional benefits to private investment. For

example, an investment in distribution facilities by a private company would do little good without an interstate highway grid. The highway system, therefore,

enhances total productivity for the economy by complementing the private investment and increasing total factor productivity.

LOS 12.i: Compare classical growth theory, neoclassical growth theory, and endogenous growth theory – 3 Models!

Classical Growth Theory: Grown in real GDP per capital is not permanent: In the long-term, given increases in capital and technological

progress, population growth increases above subsistence level, leading to diminishing marginal returns to labor, which reduces productivity

and drives GDP per capita back to the subsistence level (this theory is not supported by empirical evidence).

New Classical Growth Theory (NCGT): Focusses on estimating the economy’s long-term steady state growth rate (sustainable

growth rate or equilibrium growth rate). The point at which output-to-capital ratio is constant –at this point, the labor-to-capital ratio also

grow at the equilibrium growth rate, g*.