Page 17 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 17

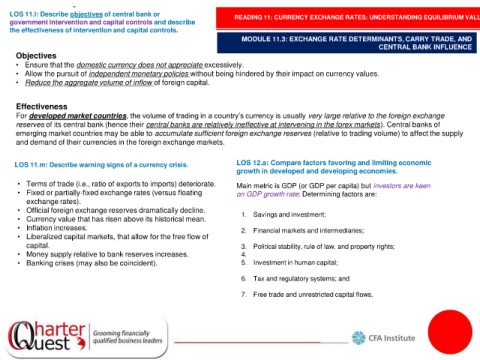

LOS 11.l: Describe objectives of central bank or READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

government intervention and capital controls and describe

the effectiveness of intervention and capital controls.

MODULE 11.3: EXCHANGE RATE DETERMINANTS, CARRY TRADE, AND

CENTRAL BANK INFLUENCE

Objectives

• Ensure that the domestic currency does not appreciate excessively.

• Allow the pursuit of independent monetary policies without being hindered by their impact on currency values.

• Reduce the aggregate volume of inflow of foreign capital.

Effectiveness

For developed market countries, the volume of trading in a country’s currency is usually very large relative to the foreign exchange

reserves of its central bank (hence their central banks are relatively ineffective at intervening in the forex markets). Central banks of

emerging market countries may be able to accumulate sufficient foreign exchange reserves (relative to trading volume) to affect the supply

and demand of their currencies in the foreign exchange markets.

LOS 11.m: Describe warning signs of a currency crisis. LOS 12.a: Compare factors favoring and limiting economic

growth in developed and developing economies.

• Terms of trade (i.e., ratio of exports to imports) deteriorate. Main metric is GDP (or GDP per capita) but investors are keen

• Fixed or partially-fixed exchange rates (versus floating on GDP growth rate: Determining factors are:

exchange rates).

• Official foreign exchange reserves dramatically decline. 1. Savings and investment;

• Currency value that has risen above its historical mean.

• Inflation increases. 2. Financial markets and intermediaries;

• Liberalized capital markets, that allow for the free flow of

capital. 3. Political stability, rule of law, and property rights;

• Money supply relative to bank reserves increases. 4.

• Banking crises (may also be coincident). 5. Investment in human capital;

6. Tax and regulatory systems; and

7. Free trade and unrestricted capital flows,