Page 16 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 16

LOS 11.k: Explain the potential effects of READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

monetary and fiscal policy on exchange rates.

MODULE 11.3: EXCHANGE RATE DETERMINANTS, CARRY TRADE, AND

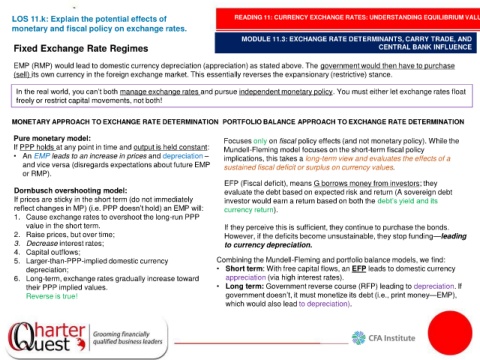

Fixed Exchange Rate Regimes CENTRAL BANK INFLUENCE

EMP (RMP) would lead to domestic currency depreciation (appreciation) as stated above. The government would then have to purchase

(sell) its own currency in the foreign exchange market. This essentially reverses the expansionary (restrictive) stance.

In the real world, you can’t both manage exchange rates and pursue independent monetary policy. You must either let exchange rates float

freely or restrict capital movements, not both!

MONETARY APPROACH TO EXCHANGE RATE DETERMINATION PORTFOLIO BALANCE APPROACH TO EXCHANGE RATE DETERMINATION

Pure monetary model: Focuses only on fiscal policy effects (and not monetary policy). While the

If PPP holds at any point in time and output is held constant: Mundell-Fleming model focuses on the short-term fiscal policy

• An EMP leads to an increase in prices and depreciation – implications, this takes a long-term view and evaluates the effects of a

and vice versa (disregards expectations about future EMP sustained fiscal deficit or surplus on currency values.

or RMP).

EFP (Fiscal deficit), means G borrows money from investors; they

Dornbusch overshooting model: evaluate the debt based on expected risk and return (A sovereign debt

If prices are sticky in the short term (do not immediately investor would earn a return based on both the debt’s yield and its

reflect changes in MP) (i.e. PPP doesn’t hold) an EMP will: currency return).

1. Cause exchange rates to overshoot the long-run PPP

value in the short term. If they perceive this is sufficient, they continue to purchase the bonds.

2. Raise prices, but over time; However, if the deficits become unsustainable, they stop funding—leading

3. Decrease interest rates; to currency depreciation.

4. Capital outflows;

5. Larger-than-PPP-implied domestic currency Combining the Mundell-Fleming and portfolio balance models, we find:

depreciation; • Short term: With free capital flows, an EFP leads to domestic currency

6. Long-term, exchange rates gradually increase toward appreciation (via high interest rates).

their PPP implied values. • Long term: Government reverse course (RFP) leading to depreciation. If

Reverse is true! government doesn’t, it must monetize its debt (i.e., print money—EMP),

which would also lead to depreciation).