Page 25 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 25

LOS 13.a: Describe classifications of regulations and regulators. READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

MODULE 13.1: ECONOMICS OF REGULATION

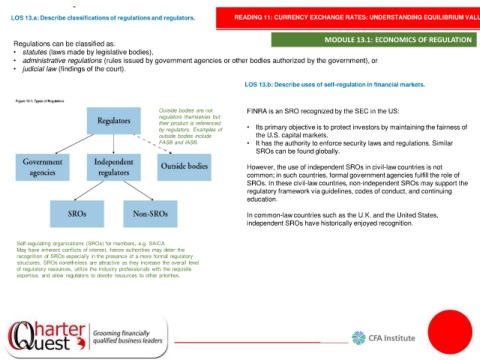

Regulations can be classified as:

• statutes (laws made by legislative bodies),

• administrative regulations (rules issued by government agencies or other bodies authorized by the government), or

• judicial law (findings of the court).

LOS 13.b: Describe uses of self-regulation in financial markets.

Outside bodies are not FINRA is an SRO recognized by the SEC in the US:

regulators themselves but

their product is referenced • Its primary objective is to protect investors by maintaining the fairness of

by regulators. Examples of

outside bodies include the U.S. capital markets.

FASB and IASB. • It has the authority to enforce security laws and regulations. Similar

SROs can be found globally.

However, the use of independent SROs in civil-law countries is not

common; in such countries, formal government agencies fulfill the role of

SROs. In these civil-law countries, non-independent SROs may support the

regulatory framework via guidelines, codes of conduct, and continuing

education.

In common-law countries such as the U.K. and the United States,

independent SROs have historically enjoyed recognition.

Self-regulating organizations (SROs) for members, e.g. SAICA

May have inherent conflicts of interest, hence authorities may deter the

recognition of SROs especially in the presence of a more formal regulatory

structures. SROs nonetheless are attractive as they increase the overall level

of regulatory resources, utilize the industry professionals with the requisite

expertise, and allow regulators to devote resources to other priorities.