Page 330 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 330

Chapter 17

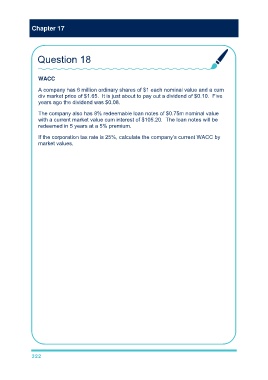

Question 18

WACC

A company has 6 million ordinary shares of $1 each nominal value and a cum

div market price of $1.65. It is just about to pay out a dividend of $0.10. Five

years ago the dividend was $0.08.

The company also has 8% redeemable loan notes of $0.75m nominal value

with a current market value cum interest of $105.20. The loan notes will be

redeemed in 5 years at a 5% premium.

If the corporation tax rate is 25%, calculate the company’s current WACC by

market values.

Ex div share price = $1.65 – $0.10 = $1.55

MV equity = 6 million × $1.55 = $9.3m

1/5

Dividend growth rate = ($0.10/$0.08) – 1 = 0.0456 or 4.6%

Ke = [D 0 (1 + g)/P 0] + g

Ke = [$0.10 × 1.046/$1.55] + 0.046 = 0.113 or 11.3%

Ex interest debt market value = $105.20 – $100 × 8% = $97.20

MV debt = $0.75m/$100 × $97.20 = $0.729m

Cost of debt to the company (use post-tax interest value)

Time cash flow d.f/a.f 5% PV d.f/a.f 10% PV

t0 £(97.20) 1 $(97.20) 1 $(97.20)

t1-5 $6.00 4.329 $25.97 3.791 $22.75

t5 $105.00 0.784 $82.32 0.621 $65.21

NPV $11.09 NPV $(9.24)

IRR = 5 + [$11.09/($11.09 – $(9.24))] × (10 – 5)

IRR = 5 + 0.545 × 5 = 7.7%

322