Page 402 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 402

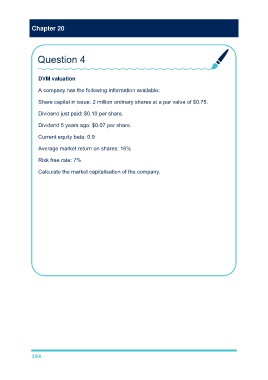

Chapter 20

Question 4

DVM valuation

A company has the following information available:

Share capital in issue: 2 million ordinary shares at a par value of $0.75.

Dividend just paid: $0.10 per share.

Dividend 5 years ago: $0.07 per share.

Current equity beta: 0.9

Average market return on shares: 16%

Risk free rate: 7%

Calculate the market capitalisation of the company.

Market capitalisation = number of shares in issue × market price per share.

P0 = D0(1 + g)/(ke – g)

Ke = Rf + β(Rm – Rf)

Ke = 7 + 0.9 × (16 – 7) = 15.1%

g = (D0/Dn)1/n – 1

g = (0.1/0.07)1/5 – 1 = 0.0739 or 7.4%

P0 = ($0.10 × 1.074)/(0.151 – 0.074) = $1.39 per share

Market capitalisation = $1.39 × 2m = $2.78m

394