Page 405 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 405

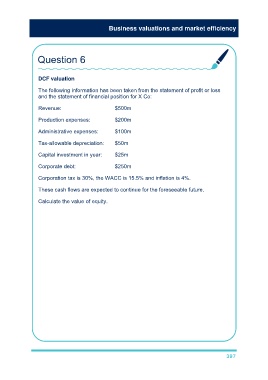

Business valuations and market efficiency

Question 6

DCF valuation

The following information has been taken from the statement of profit or loss

and the statement of financial position for X Co:

Revenue: $500m

Production expenses: $200m

Administrative expenses: $100m

Tax-allowable depreciation: $50m

Capital investment in year: $25m

Corporate debt: $250m

Corporation tax is 30%, the WACC is 15.5% and inflation is 4%.

These cash flows are expected to continue for the foreseeable future.

Calculate the value of equity.

Operating profits = $500m – $200m – $100m = $200m

Tax on operating profits = $200m × 0.3 = $60m

Tax relief on tax-allowable depreciation: $50m × 0.3 = $15m

Free cash flow = $200m – $60m + $15m – $25m = $130m

Using the real method for discounting (don’t inflate the cash flows and use the

real discount rate):

The cash flows will be a perpetuity of $130m

The real discount rate will be (1.155/1.04) – 1 = 0.11 or 11%

PV of perpetuity = $130m × 1/0.11 = $1,182m

This values the entire cash flows of the business. To obtain the value of equity

alone, we must deduct the debt value.

Value of equity = $1,182m – $250m = $932m

397