Page 408 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 408

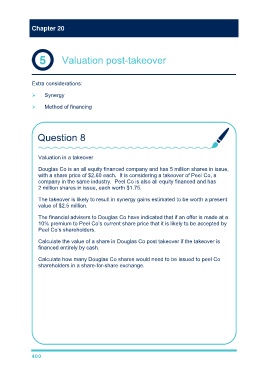

Chapter 20

Valuation post-takeover

Extra considerations:

Synergy (adds value to the combined entity)

Method of financing (cash reduces value, share for share reduces value per

share)

Question 8

Valuation in a takeover

Douglas Co is an all equity financed company and has 5 million shares in issue,

with a share price of $2.60 each. It is considering a takeover of Peel Co, a

company in the same industry. Peel Co is also all equity financed and has

2 million shares in issue, each worth $1.75.

The takeover is likely to result in synergy gains estimated to be worth a present

value of $2.5 million.

The financial advisers to Douglas Co have indicated that if an offer is made at a

10% premium to Peel Co’s current share price that it is likely to be accepted by

Peel Co’s shareholders.

Calculate the value of a share in Douglas Co post takeover if the takeover is

financed entirely by cash.

Calculate how many Douglas Co shares would need to be issued to peel Co

shareholders in a share-for-share exchange.

Financed by cash:

Douglas Co current value: 5m × $2.60 = $13m

Purchased value of Peel Co added to Douglas Co’s value: 2m × $1.75 = $3.5m

Synergy gained and added to Douglas Co value: $2.5m

Cash paid out, reducing the value of Douglas: $3.5m × 1.1 = $3.85m

Total post takeover value of Douglas Co: $15.15m

400