Page 442 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 442

Chapter 20

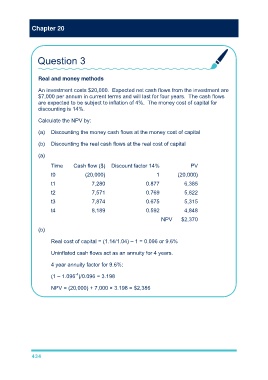

Question 3

Real and money methods

An investment costs $20,000. Expected net cash flows from the investment are

$7,000 per annum in current terms and will last for four years. The cash flows

are expected to be subject to inflation of 4%. The money cost of capital for

discounting is 14%.

Calculate the NPV by:

(a) Discounting the money cash flows at the money cost of capital

(b) Discounting the real cash flows at the real cost of capital

(a)

Time Cash flow ($) Discount factor 14% PV

t0 (20,000) 1 (20,000)

t1 7,280 0.877 6,385

t2 7,571 0.769 5,822

t3 7,874 0.675 5,315

t4 8,189 0.592 4,848

NPV $2,370

(b)

Real cost of capital = (1.14/1.04) – 1 = 0.096 or 9.6%

Uninflated cash flows act as an annuity for 4 years.

4 year annuity factor for 9.6%:

-4

(1 – 1.096 )/0.096 = 3.198

NPV = (20,000) + 7,000 × 3.198 = $2,386

434