Page 447 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 447

Business valuations and market efficiency

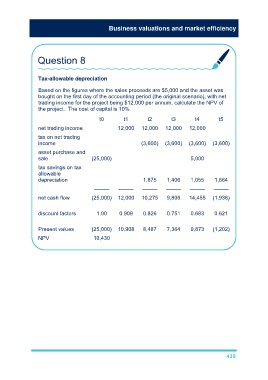

Question 8

Tax-allowable depreciation

Based on the figures where the sales proceeds are $5,000 and the asset was

bought on the first day of the accounting period (the original scenario), with net

trading income for the project being $12,000 per annum, calculate the NPV of

the project. The cost of capital is 10%.

t0 t1 t2 t3 t4 t5

net trading income 12,000 12,000 12,000 12,000

tax on net trading

income (3,600) (3,600) (3,600) (3,600)

asset purchase and

sale (25,000) 5,000

tax savings on tax

allowable

depreciation 1,875 1,406 1,055 1,664

––––– ––––– ––––– ––––– ––––– –––––

net cash flow (25,000) 12,000 10,275 9,806 14,455 (1,936)

discount factors 1.00 0.909 0.826 0.751 0.683 0.621

Present values (25,000) 10,908 8,487 7,364 9,873 (1,202)

NPV 10,430

439