Page 445 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 445

Business valuations and market efficiency

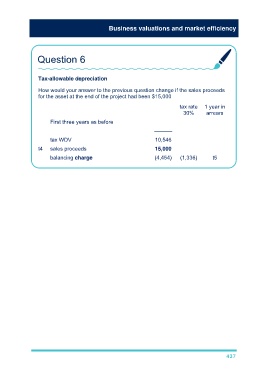

Question 6

Tax-allowable depreciation

How would your answer to the previous question change if the sales proceeds

for the asset at the end of the project had been $15,000

tax rate 1 year in

30% arrears

First three years as before

––––––

tax WDV 10,546

t4 sales proceeds 15,000

balancing charge (4,454) (1,336) t5

437