Page 449 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 449

Business valuations and market efficiency

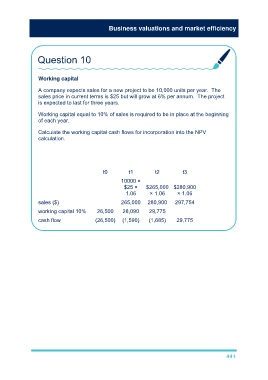

Question 10

Working capital

A company expects sales for a new project to be 10,000 units per year. The

sales price in current terms is $25 but will grow at 6% per annum. The project

is expected to last for three years.

Working capital equal to 10% of sales is required to be in place at the beginning

of each year.

Calculate the working capital cash flows for incorporation into the NPV

calculation.

t0 t1 t2 t3

10000 ×

$25 × $265,000 $280,900

1.06 × 1.06 × 1.06

sales ($) 265,000 280,900 297,754

working capital 10% 26,500 28,090 29,775

cash flow (26,500) (1,590) (1,685) 29,775

441