Page 510 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 510

Chapter 20

Chapter 17

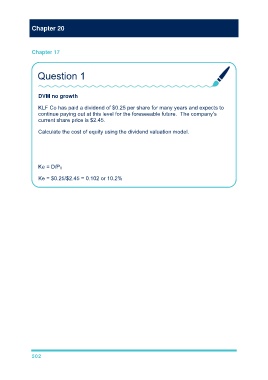

Question 1

DVM no growth

KLF Co has paid a dividend of $0.25 per share for many years and expects to

continue paying out at this level for the foreseeable future. The company’s

current share price is $2.45.

Calculate the cost of equity using the dividend valuation model.

Ke = D/P 0

Ke = $0.25/$2.45 = 0.102 or 10.2%

502