Page 514 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 514

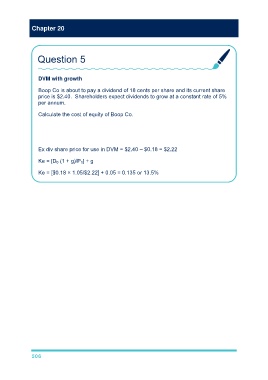

Chapter 20

Question 5

DVM with growth

Boop Co is about to pay a dividend of 18 cents per share and its current share

price is $2.40. Shareholders expect dividends to grow at a constant rate of 5%

per annum.

Calculate the cost of equity of Boop Co.

Ex div share price for use in DVM = $2.40 – $0.18 = $2.22

Ke = [D 0 (1 + g)/P 0] + g

Ke = [$0.18 × 1.05/$2.22] + 0.05 = 0.135 or 13.5%

506