Page 513 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 513

Business valuations and market efficiency

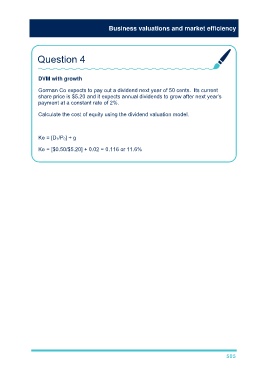

Question 4

DVM with growth

Gorman Co expects to pay out a dividend next year of 50 cents. Its current

share price is $5.20 and it expects annual dividends to grow after next year’s

payment at a constant rate of 2%.

Calculate the cost of equity using the dividend valuation model.

Ke = [D 1/P 0] + g

Ke = [$0.50/$5.20] + 0.02 = 0.116 or 11.6%

505