Page 401 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 401

Answers

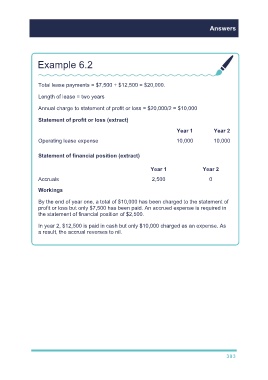

Example 6.2

Total lease payments = $7,500 + $12,500 = $20,000.

Length of lease = two years

Annual charge to statement of profit or loss = $20,000/2 = $10,000

Statement of profit or loss (extract)

Year 1 Year 2

Operating lease expense 10,000 10,000

Statement of financial position (extract)

Year 1 Year 2

Accruals 2,500 0

Workings

By the end of year one, a total of $10,000 has been charged to the statement of

profit or loss but only $7,500 has been paid. An accrued expense is required in

the statement of financial position of $2,500.

In year 2, $12,500 is paid in cash but only $10,000 charged as an expense. As

a result, the accrual reverses to nil.

393