Page 406 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 406

Chapter 20

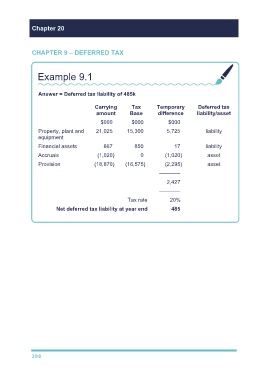

CHAPTER 9 – DEFERRED TAX

Example 9.1

Answer = Deferred tax liability of 485k

Carrying Tax Temporary Deferred tax

amount Base difference liability/asset

$000 $000 $000

Property, plant and 21,025 15,300 5,725 liability

equipment

Financial assets 867 850 17 liability

Accruals (1,020) 0 (1,020) asset

Provision (18,870) (16,575) (2,295) asset

–––––––

2,427

–––––––

Tax rate 20%

Net deferred tax liability at year end 485

398