Page 404 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 404

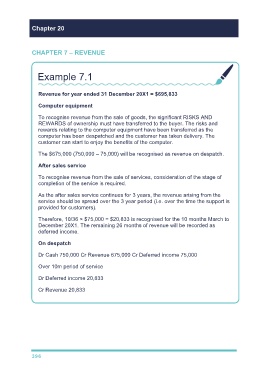

Chapter 20

CHAPTER 7 – REVENUE

Example 7.1

Revenue for year ended 31 December 20X1 = $695,833

Computer equipment

To recognise revenue from the sale of goods, the significant RISKS AND

REWARDS of ownership must have transferred to the buyer. The risks and

rewards relating to the computer equipment have been transferred as the

computer has been despatched and the customer has taken delivery. The

customer can start to enjoy the benefits of the computer.

The $675,000 (750,000 – 75,000) will be recognised as revenue on despatch.

After sales service

To recognise revenue from the sale of services, consideration of the stage of

completion of the service is required.

As the after sales service continues for 3 years, the revenue arising from the

service should be spread over the 3 year period (i.e. over the time the support is

provided for customers).

Therefore, 10/36 × $75,000 = $20,833 is recognised for the 10 months March to

December 20X1. The remaining 26 months of revenue will be recorded as

deferred income.

On despatch

Dr Cash 750,000 Cr Revenue 675,000 Cr Deferred income 75,000

Over 10m period of service

Dr Deferred income 20,833

Cr Revenue 20,833

396