Page 407 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 407

Answers

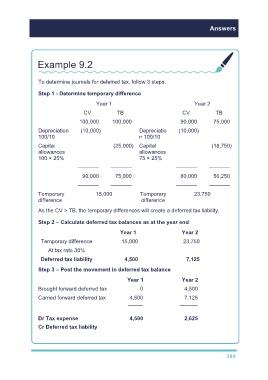

Example 9.2

To determine journals for deferred tax, follow 3 steps.

Step 1 - Determine temporary difference

Year 1 Year 2

CV TB CV TB

100,000 100,000 90,000 75,000

Depreciation (10,000) Depreciatio (10,000)

100/10 n 100/10

Capital (25,000) Capital (18,750)

allowances allowances

100 × 25% 75 × 25%

––––––– ––––––– ––––––– –––––––

90,000 75,000 80,000 56,250

––––––– ––––––– ––––––– –––––––

Temporary 15,000 Temporary 23,750

difference difference

As the CV > TB, the temporary differences will create a deferred tax liability.

Step 2 – Calculate deferred tax balances as at the year end

Year 1 Year 2

Temporary difference 15,000 23,750

At tax rate 30%

Deferred tax liability 4,500 7,125

Step 3 – Post the movement in deferred tax balance

Year 1 Year 2

Brought forward deferred tax 0 4,500

Carried forward deferred tax 4,500 7,125

––––– ––––––

Dr Tax expense 4,500 2,625

Cr Deferred tax liability

399