Page 446 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 446

Chapter 20

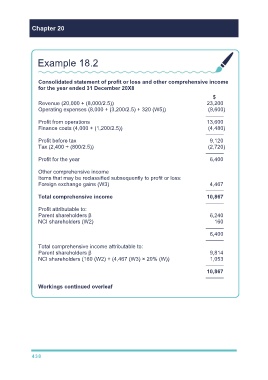

Example 18.2

Consolidated statement of profit or loss and other comprehensive income

for the year ended 31 December 20X8

$

Revenue (20,000 + (8,000/2.5)) 23,200

Operating expenses (8,000 + (3,200/2.5) + 320 (W5)) (9,600)

––––––

Profit from operations 13,600

Finance costs (4,000 + (1,200/2.5)) (4,480)

––––––

Profit before tax 9,120

Tax (2,400 + (800/2.5)) (2,720)

––––––

Profit for the year 6,400

Other comprehensive income

Items that may be reclassified subsequently to profit or loss:

Foreign exchange gains (W3) 4,467

––––––

Total comprehensive income 10,867

––––––

Profit attributable to:

Parent shareholders β 6,240

NCI shareholders (W2) 160

––––––

6,400

––––––

Total comprehensive income attributable to:

Parent shareholders β 9,814

NCI shareholders (160 (W2) + (4,467 (W3) × 20% (W)) 1,053

––––––

10,867

––––––

Workings continued overleaf

438