Page 445 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 445

Answers

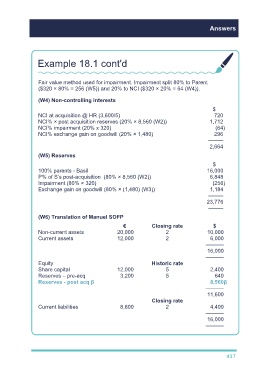

Example 18.1 cont'd

Fair value method used for impairment. Impairment split 80% to Parent

($320 × 80% = 256 (W5)) and 20% to NCI ($320 × 20% = 64 (W4)).

(W4) Non-controlling interests

$

NCI at acquisition @ HR (3,600/5) 720

NCI% × post acquisition reserves (20% × 8,560 (W2)) 1,712

NCI% impairment (20% x 320) (64)

NCI% exchange gain on goodwill (20% × 1,480) 296

–––––

2,664

(W5) Reserves

$

100% parents - Basil 16,000

P% of S’s post-acquisition (80% × 8,560 (W2)) 6,848

Impairment (80% × 320) (256)

Exchange gain on goodwill (80% × (1,480) (W3)) 1,184

–––––

23,776

–––––

(W6) Translation of Manuel SOFP

€ Closing rate $

Non-current assets 20,000 2 10,000

Current assets 12,000 2 6,000

––––––

16,000

––––––

Equity Historic rate

Share capital 12,000 5 2,400

Reserves – pre-acq 3,200 5 640

Reserves - post acq β 8,560β

––––––

11,600

Closing rate

Current liabilities 8,800 2 4,400

––––––

16,000

––––––

437