Page 444 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 444

Chapter 20

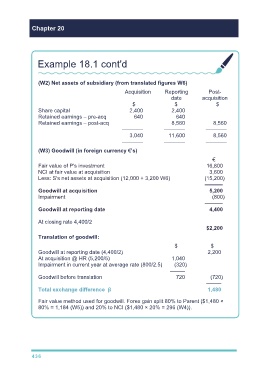

Example 18.1 cont'd

(W2) Net assets of subsidiary (from translated figures W6)

Acquisition Reporting Post-

date acquisition

$ $ $

Share capital 2,400 2,400

Retained earnings – pre-acq 640 640

Retained earnings – post-acq 8,560 8,560

––––––– ––––––– –––––––

3,040 11,600 8,560

––––––– ––––––– –––––––

(W3) Goodwill (in foreign currency €’s)

€

Fair value of P's investment 16,800

NCI at fair value at acquisition 3,600

Less: S's net assets at acquisition (12,000 + 3,200 W6) (15,200)

––––––

Goodwill at acquisition 5,200

Impairment (800)

––––––

Goodwill at reporting date 4,400

At closing rate 4,400/2

$2,200

Translation of goodwill:

$ $

Goodwill at reporting date (4,400/2) 2,200

At acquisition @ HR (5,200/5) 1,040

Impairment in current year at average rate (800/2.5) (320)

–––––

Goodwill before translation 720 (720)

–––––

Total exchange difference β 1,480

Fair value method used for goodwill. Forex gain split 80% to Parent ($1,480 ×

80% = 1,184 (W5)) and 20% to NCI ($1,480 × 20% = 296 (W4)).

436