Page 4 - F6 Slides (CGT,TT,ET AND PT)

P. 4

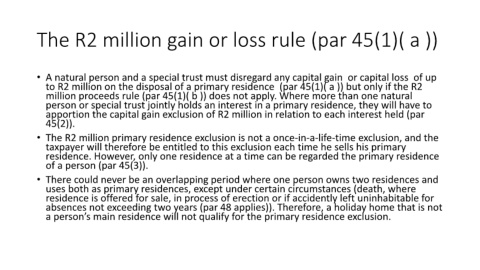

The R2 million gain or loss rule (par 45(1)( a ))

• A natural person and a special trust must disregard any capital gain or capital loss of up

to R2 million on the disposal of a primary residence (par 45(1)( a )) but only if the R2

million proceeds rule (par 45(1)( b )) does not apply. Where more than one natural

person or special trust jointly holds an interest in a primary residence, they will have to

apportion the capital gain exclusion of R2 million in relation to each interest held (par

45(2)).

• The R2 million primary residence exclusion is not a once-in-a-life-time exclusion, and the

taxpayer will therefore be entitled to this exclusion each time he sells his primary

residence. However, only one residence at a time can be regarded the primary residence

of a person (par 45(3)).

• There could never be an overlapping period where one person owns two residences and

uses both as primary residences, except under certain circumstances (death, where

residence is offered for sale, in process of erection or if accidently left uninhabitable for

absences not exceeding two years (par 48 applies)). Therefore, a holiday home that is not

a person’s main residence will not qualify for the primary residence exclusion.