Page 5 - F6 Slides (CGT,TT,ET AND PT)

P. 5

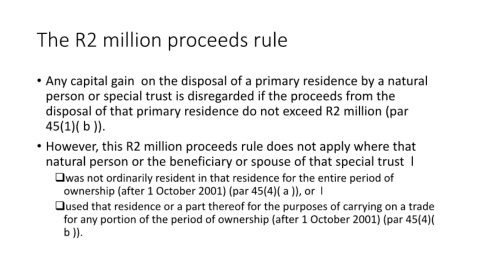

The R2 million proceeds rule

• Any capital gain on the disposal of a primary residence by a natural

person or special trust is disregarded if the proceeds from the

disposal of that primary residence do not exceed R2 million (par

45(1)( b )).

• However, this R2 million proceeds rule does not apply where that

natural person or the beneficiary or spouse of that special trust l

was not ordinarily resident in that residence for the entire period of

ownership (after 1 October 2001) (par 45(4)( a )), or l

used that residence or a part thereof for the purposes of carrying on a trade

for any portion of the period of ownership (after 1 October 2001) (par 45(4)(

b )).