Page 7 - F6 Slides (CGT,TT,ET AND PT)

P. 7

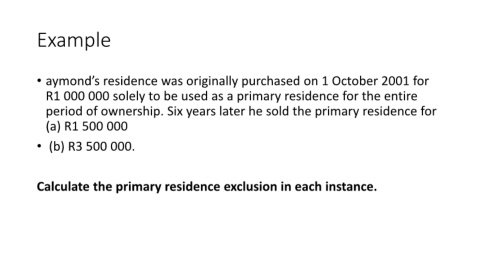

Example

• aymond’s residence was originally purchased on 1 October 2001 for

R1 000 000 solely to be used as a primary residence for the entire

period of ownership. Six years later he sold the primary residence for

(a) R1 500 000

• (b) R3 500 000.

Calculate the primary residence exclusion in each instance.